Interest Calculation in Tally

Interest Calculation

Interest

is the return out of investments or chargeable expenses or income out of the

loan taken and also for the delay payment and vice versa. Interest is an amount

charged to the borrower for the privilege of using the ledger’s money.

Types of Interest:

1.

Simple Interest:

Interest is calculated on principle

amount at a specified rate for a specified period.

For

Example principle amount is ₹..50,000/-

and the rate is 10% for 2 years, the

interest amount can be calculated as follows.

For1st,

2nd year interest will be ₹.5000/-.

Amount

for 2 year is the same .i.e. ₹.5000/-.

2. Compound Interest:

Interest is calculated on principle

amount and interest accrued but not claimed.

Compound interest is when interest is earned

not only on the initial amount invested, but also on any interest

For

Example principle amount is ₹..50,000/-

and the rate is 10% for 2 years, the

interest amount can be calculated as follows.

For

1st year interest will be ₹.5000/-. (Interest

calculated for only principle amt)

For

2nd year interest will be ₹.5500/-. (Interest

calculated for principle amt + interest of 1st year) (50000 x 11%)

Basic of interest

Calculation:

a): On outstanding balance amounts:

Interest

calculation on outstanding balance is allowed for any ledger account like loan

account, debtor’s account, creditors account and bank account etc.,

b). On Outstanding Bills/invoices/Transaction:

Interest

calculated for each transaction – by – transaction,

e.g sundry debtors, sundry

creditors. This mode is possible for the ledger with the feature of bill wise

details.

Style of Interest:

i. 30 days a month:

Interest will be calculated by

considering the interest period as 30 days for every month.

ii. 365 days year:

Under

this style interest will be calculated for 365 days for every year even though

the year has 366 days in case of leap year.

iii. Calendar month:

Interest

will be calculated based on the days of particular month, which will very for

every month. In case of January, interest will be calculated for 31 days and 28

days in case of February.

iv. Calendar Year:

Interest will be calculated based on the days of particular year, which will very for every year.

Mode of Interest:

1.

Simple mode applicable for

single rate of interest for particular period. Under this mode rate of interest

period of interest will be fixed.

2.

Advance mode to get

different rate of interest for different period.

Choice of balances:

Choice of balances for which the

interest has to be calculated from the Interest Balances list in the On field.

The balances are All Balances, Credit Balances only and Debit balances only. Interest can be

calculated on all outstanding balances, whether debit or credit. You would like

to select only credit balances in

case of accounts like Bank accounts,

if you want to know the interest that the bank might charge on overdrawn

balances.

Rounding Method:

a) Normal Rounding – Round off the calculated value to the Nearest

lower number that is a multiple of

the rounding limit specified if the decimal value is less than 0.5. For

example, if the invoice value is 125.30, the value will be rounded off to 125,

and the round off ledger will have the value (-)0.30.

Nearest higher number that is a multiple of the

rounding limit specified if the decimal value is more than or equal to 0.5. For

example, if the value is 125.60, it will be rounded off to 126, and the round

off ledger will have the value 0.40 (when the Rounding limit is set to 1).

b)

Upward Rounding – Round off the invoice value to the nearest

higher number that is a multiple of the rounding limit specified. For example,

if the calculated value is 125.30, the value will be rounded to 126.

c)

Downward Rounding - Round off the invoice value to the nearest lower

number that is a multiple of the rounding limit specified. For example, if the

calculated value is 125.30, the value will be rounded off to 125.

d)

Not Applicable:

Example:

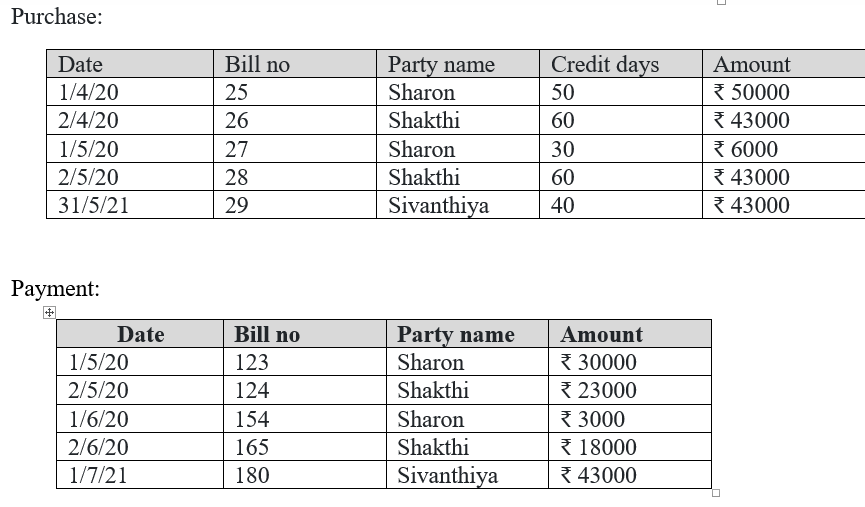

Calculate the Interest for the following :

1. Outstanding Value for Suresh debtor is ₹.50,000 and the rate of 10% for year

2.

On 1.4.2020

the opening balance loan was ₹.2,50,000/- in the IOB bank at the rate of 15%

with the Rounding value is normal and the period was April 2020 to May 2020.

12

% interest for June 2020 to August 2020 Rounding is Upward.

And

10 % for remaining months with the Rounding is downward.

(Rounding limit for all is 1)

To know how to do:

Comments

Post a Comment